As we near tax day it makes sense to review a matter most

people either don’t understand or don’t really think about – the issue of tax

deductibility, what it really means and how people use it to sell goods, ideas

and charitable causes.

What happened next? The banks began heavily marketing home

equity loans. Buy your car but use your house as collateral and still

deduct the interest. (This is another example of how we must look after

ourselves rather than relying on consumer protection agencies, because when it

comes to finances, bankers are a lot smarter than politicians and will come up

with new products to take advantage of any rule changes.)

When we hear this promise of tax deductibility from anyone,

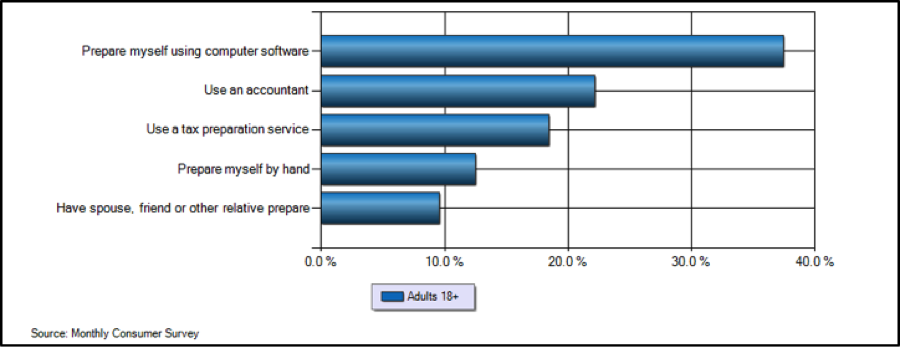

what does it really mean and how much of an advantage is it? Since fewer than one in seven people even look at a tax

form anymore (see graph), preferring to hand the box of receipts off to someone else or

to wade through the hundreds of questions delivered by tax preparation software

that mysteriously translates all the answers into the lines on a 1040 form, I

think most don’t have a clue about the mild deceit going on here. Not everything that is legally tax-deductible

and listed on your return provides any benefit at all.

Here’s how it works.

Everyone can choose either itemizing those deductions or claiming an

automatic standard deduction. Based on

data from last year only about 31% chose to list all their deductions. The rest took the standard deduction. Deductions that may be itemized include mortgage interest, property taxes, certain other taxes, contributions to eligible

charities, medical expenses (but only for the amount above 7.5% of your income)

and certain other unreimbursed employee expenses, such as job travel, union

dues, job education, etc.

The standard deduction, the one you could get no matter what

is $6300 for a single person and $12,600 for a married couple. So the value of the first $12,600 of

deductions for a married couple (filing jointly) is exactly zero! You could get it any way regardless of your

other decisions! Suppose you have no major

health expenses, mortgage interest of $6,000, property tax of $3000, state

income tax of $2500 and donations of $1500; the total is only $400 above the

standard deduction. If you are in the

25% tax bracket, your taxes are lowered by $100. On one hand, it’s nice to get an extra $100

back from the government. On the other

hand, is that what you expected when the realtor sold you the house with the

promise of tax deductibility? (And don’t

forget, the interest paid will be going down every year as the principal is

paid down and the standard deduction may go up, so you have less chance to reach that break-even point.)

I know it’s usually painful to think about taxes at all, but

when someone is using an idea to sell you something, it’s wise to be informed and to have done a little of the math. In

reality the only decisions that should be influenced by the promise of tax

deductibility are the ones made after you know that the initial $12,600 has already been met.

No comments:

Post a Comment

Click again on the title to add a comment